By Dick Glass, CET

Balance sheets are another valuable tool to help you analyze the long-term health of your business. They are second in importance only to profit-and-loss statements, which rate the top priority among financial reports.

Who Needs Balance Sheets?

After reading three installments of this series, you should have decided on definite financial goals for the year. And you are familiar with the basics of profit-and-loss (P&L) statements. After P&Ls, "balance sheets" might seem superfluous. After all, your P&Ls show that the various ratios are in line with good business practices, and you are making a normal profit. Doesn't this prove that P&Ls satisfy all of your business needs? No, that's not true. I'll agree that analysis of P&Ls takes priority over the information from balance sheets. It is imperative for you first to identify and correct any excessive expenses or inadequate profits from parts sales. Also, repeated losses of net profit eventually will force you into bankruptcy. These are ad vantages of P&Ls. Even so, balance sheets are almost as important to your business as P&Ls are.

The Complete Picture

A balance sheet supplies a complete financial picture of your business at a given date. You might believe a P&L does that, but it doesn't. Each P&L shows (1) how much money you received; (2) how much you paid out; and (3) how much money remains as net profit after the period of time.

Unfortunately, a P&L can't show these important factors:

• the amount of your net worth;

• whether your assets are growing or decreasing; and

• the total amount of debts you have.

Although a P&L showing a substantial net profit for the period might give you a feeling of security, it's even better when you compare balance sheets for the beginning and ending of the period and learn that your total assets have grown!

An Extreme Example

We'll exaggerate and imagine that you became frustrated with the problems of obtaining parts rapidly.

In an attempt to have all needed parts immediately, you bought an entire warehouse of electronic parts at a price of $200,000. If you normally sell $50,000 worth of parts per year, this would be a four-year supply. Because of the adequate parts inventory, your parts sales and parts profits (as shown on the P&L) are increased (perhaps higher profits of $5,000 from extra sales of $10,000). But, look at the other side of the situation. If you had invested the $200,000 in saving certificates, you could have earned $15,000 per year.

That's three times as much as the extra $5,000 earned by increased parts sales! This is one example of a P&L that gave a false impression by not listing inventory size. However, the balance sheet would have spotted it by showing an overbalanced investment in parts.

Another example is when the owner withdraws more money than the business makes in net profit.

For short periods, this might not be detrimental. It could be disastrous if the periodic balance sheets were not monitored to check against a continual shrinkage of net worth or operating capital.

Ratios P&Ls have several important ratios that you should be aware of constantly. In the same way, comparisons from balance sheets are equally important. Another valuable tool is to compare certain P&L percentages with figures from the balance sheet.

In summary, you can have P&L ratios, balance-sheet ratios, and combination P&L versus balance sheet ratios. It's impossible to have a complete financial picture of your business without both P&L statements and balance sheets.

In fact, many businesses order both each month from their accountants. If you have a small business (perhaps less than six employees) and you are very close to all areas of the business, one balance sheet per year might be enough.

Employee's Personal Balance Sheet

Of course, employees have little interest in the balance sheets of a business. But you and your family have a financial condition, just as businesses do; and, if you try to borrow money from a bank, the banker will need the kind of information listed on balance sheets.

Also, if you ever have ambitions about forming your own business company, you should learn about balance sheets now. Incidentally, the balance sheets of many single proprietorship (one owner) businesses are more like a personal "financial status" statement of the owner than they are of a company.

Example of a Personal Balance Sheet

Figure 1 is a hypothetical person al balance sheet, which you can compare with business balance sheets to show the similarities between them.

In Figure 1, Dick Smith's net worth is $19,200. Without any major misfortunes during the year, his January 1, 1979, balance sheet should show equity increases in his house, auto, and insurance policy.

His stock or savings account might increase in value, or the cash on hand could be higher than before.

All of these things increase his net worth.

------------ Figure 1 Individuals or families also can have "balance sheets" to prove net worth. Although business balance sheets add more items and include more details, the general layout is similar to this one.

DICK SMITH PERSONAL BALANCE SHEET

Jan 1, 1978

-------------

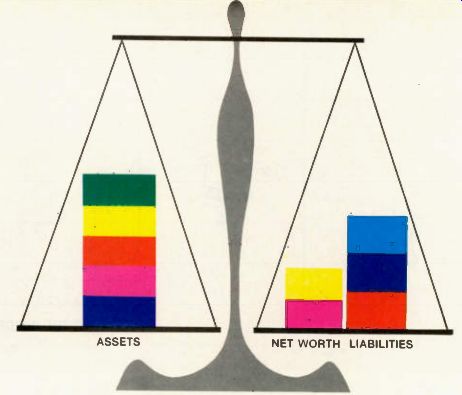

Figure 2 This is a simple, but complete, balance sheet for a business. It shows what is owned and what is owed at a specific time. The total net worth is added to the liabilities because net worth is owed to the owner just as the liabilities are owed to outsiders. Assets less liabilities equals net worth. For bookkeeping purposes, the value of al assets should equal (balance) the sum of the liabilities and the net worth.

Figure 3 When two or more balance sheets are compared it's possible to detect trends and determine if the various "ratios" are becoming better or worse. This illustration contains two balance sheets of consecutive years, thus making comparisons easy.

Notice that the house is shown in the assets column at the original price paid for it, but the other asset items are listed at the current market value. Of course, the house could be listed for the present value (which probably would be higher because of inflation), except for the difficulty of obtaining an appraisal each year. However, a bank would want to know the market value of the house if they were investigating your request for a loan. At such times, a current appraisal is necessary. On the other hand, autos and personal effects should not be listed by the purchase cost because rapid depreciation prevents any resale at prices near the original cost. There fore, it is more accurate to estimate the present true value on personal balance sheets.

For business balance sheets, the original cost of buildings, vehicles, and other assets is shown, in addition to the amounts of depreciation. This is an advantage because depreciation is a deductible expense which reduces the taxes.

You can see that balance sheets are easy to prepare. There are many variations, but they contain nothing mysterious or difficult. Use Figure 1 and calculate Dick Smith's net worth if he had a $29,000 mortgage. $3,000 owed on an auto, and $8,000 in charge accounts.

Answer: His net worth would be zero. People who declare bankruptcy often have a "negative" net worth (they owe more liabilities than they have assets). Remember this definition: A balance sheet shows what you owe and what you own at a given date.

Confusing Balance Sheets?

Some technicians are confused by balance sheets. One reason is that "liabilities plus net worth equals the total assets." You might ask: "Why should I add something desirable (equity or net worth) to something that is bad (liabilities) to equal the value of my total assets?" Here is the reason: Both liabilities and net worth actually are debts! Of course, it's easy to under stand that liabilities are debts, but can net worth be a liability? "Net worth is my nest egg. It's the money or value I have invested over the years in the business. I'm always trying to increase net worth.

How can it be a debt?" Look at it this way: Net worth is owed by the business to YOU, just as the liabilities are owed to outsiders. All of the assets are owed either to you or to your creditors.

Business Balance Sheet

Examine the business balance sheet of Figure 2 and you'll notice many similarities to the personal balance sheet analyzed before. The assets are divided into "current" and "fixed" categories, and the liabilities are called "short term" and "long term." Both balance sheets "balance," show the true net worth, and list amount owed in liabilities.

Is Smith's TV "Healthy"? The P&L of Smith's business shows that it is operating with a profit. But, that's not enough to prove good financial health. There is a standard formula-the ratio of assets to liabilities-called the "cur rent ratio." A two-to-one (or higher) ratio of assets to liabilities is considered to be satisfactory. In Figure 2, the assets were $25,000 and the liabilities were $9,000. This is a 2.7:1 ratio, which is better than satisfactory.

Any accountant, banker, or financial authority would consider Smith's business to be in good condition. Of course, the business is very small, and no one will loan him any large sums of money yet.

But, if the business grows and remains in good financial health, the P&Ls and balance sheets will be of value in proving that he has sound knowledge of financial management.

Equity

We stated that equity was any portion of the assets not owed to outside creditors. Equity is the in vestment of the owner, plus the profits left in the business. (Of course, it might be minus the losses!) Sometimes equity is called proprietorship, net worth, or capital plus retained earnings. But, what ever the name, it's the value of the business after the liabilities are deducted from the assets.

Long-And Short-Term Liabilities

On business balance sheets, the liabilities are split into two types, to make clear the kinds of debts.

Short-term debts (such as distributor bills, truck payments, or small bank loans) are those due to be paid within one year. Mortgage or note payments that are not due for a year or more, are called long-term debts.

Each yearly balance sheet should show an allowance for future in come taxes, the ones to be paid on current-year profits.

Current Assets and Fixed Assets

Current assets include cash (on hand and in the bank), accounts receivable, and inventory. It's assumed that these can be converted to cash during the current year.

Fixed assets are those not expected to be converted to cash during the year (or accounting period). These include the business building (if you own or are buying it), test equipment, vehicles, and store fixtures.

A More Realistic Balance Sheet

Although the first two examples were true balance sheets, they were simple. Figure 3 shows one that is more typical of those for your business.

By comparing the current balance sheet with the one of last year, you can spot any changes, and whether they were beneficial or not.

Let's assume that these changes of Mr. Smith's business occurred during 1977:

• accounts receivable increased by $1,000 (33 1/2%);

• parts inventory increased by $3,000 (60%); and he purchased a new truck for $5,000 by using a bank loan.

Analysis

By comparing the two balance sheets (Figure 3), we can prove the following:

(1) Smith TV lost money during 1977 (net worth decreased by $1,000, so the P&L must show the same loss).

(2) The business appeared to be more prosperous because of the new truck and the increased parts stock.

(3) Assets increased from $19,500 to $25.300. The current ratio is 2:1, which remains satisfactory. But notice that last year it was 4.2:1.

(4) Smith invested $800 in cash (increased total cash on hand and in the bank), realized $1,000 more in accounts receivable, invested $3,000 more in parts, and spent $5.000 for a new truck.

Perhaps his net loss for 1977 was caused by higher interest charges plus larger depreciation expenses. However, a minor benefit of the bigger depreciation expense is to reduce taxes for the year. This is helpful since he extended himself somewhat by going into debt.

(5) If his January 1, 1977, equity of $17,300 had been converted to cash and invested in a savings plan at 7.5% interest, he would have received about $1,300 interest for the year. As it is, he shows a $1,000 loss on the investment.

(6) It's likely that the loss during the year was caused by inadequate prices of both parts and labor. To reverse the downward trend, he must become more profitable.

Hopefully, the reduced equity and P&L loss might have been produced by the owner withdrawing a large amount for salary. If true, this would not make the balance sheet appear so discouraging.

Ratios In the near future, I'll discuss in detail "ratio analysis" for service shops. But, while our minds are absorbed in balance sheets, we'll touch on the subject.

Current ratio

As explained, the current ratio should be at least 2:1. If so, it answers yes to the question: "Does the business have enough current assets to meet the current debts, with a margin of safety to cover possible losses from inventory short ages or poor collections?"

Return on owner's equity

This return should be above the amount you could receive in interest, if the total were invested in savings accounts or securities.

(Many service shop owners believe a return of 25% or larger is not excessive for money risked in the business. For Dick Smith TV, this would be $4,000 profit for the year of 1977. Notice that this should NOT be considered as wages for the owner, but strictly as interest on the money he has invested. He should pay himself an equivalent technician or management salary for the services he renders.

Inventory turns

The amount invested in inventory is shown on the balance sheet, and the P&L lists the cost of parts sold for the year. From these you can compute your inventory turns by dividing the cost by the average inventory of parts (calculated by adding the beginning and the ending inventories and dividing by two). If the parts cost of last year was $25,000 and the average inventory was $6,500 ($8,000 + $5,000 X 1 / 2 ), the inventory turns were nearly 4 times.

Now, inventory turns is a difficult area to establish a precise figure that separates good and bad performance. One problem is that smaller shops are unable to per form enough volume of service work to provide more than two or three turns per year. Also, it's difficult to obtain more than a very few inventory turns in shops that do a large percentage of warranty repairs.

However, knowing your inventory turns ratio is useful for providing a figure for judging future improvements.

Questions

We believe that, after you work with P&Ls and balance' sheets and obtain some of the benefits, you will enjoy working with them.

Consider them as financial diagnostic equipment, just as scopes and digital meters are equipment for electronic diagnosis.

Probably you now have questions about certain bookkeeping procedures; but after you study these articles and ask for advice from your accountant, it's likely you will find the answers. If not, write to me in care of Electronic Servicing. Any subjects or questions that bother many of you will be explained in later articles.

Next Month:

Methods of setting prices that are fair to both you and your customers will be analyzed and discussed next month.

Corrections:

In Figure 1 on page 28 of Service Management Seminar, Part 2 in February Electronic Servicing, one shade of blue was omitted from the graph of the "1-lours Worked" section. Tech A should be shown as working seven hours and having one hour of non productive time, while Tech B worked only four hours and "goofed off" for another four hours.

Also, paragraph 3 of column 3 on page 30 of the same article should have read: Don't base the productivity rating on the number of hours actually worked or the technician's wages. The first rule is to figure each technician's productivity from the dollars he brings in.

(adapted from: Electronic Servicing magazine, Apr. 1978)

Next: Service Management seminar, Part 5

Prev: