HERE are several reasons why no book on hi-fi installation work can be considered complete without some discussion of legal considerations. One of them is that ignorance of the legal factors involved may lead you to incur legal liability for some staggering sums of money, whether you are in the business of installing hi-fi or are just putting in a system for yourself. Do we need to any other reasons? The law of the land is written and interpreted in ways that are sometimes mysterious and frequently totally incomprehensible to the layman, which means anyone not trained in law, regardless of how much he knows in other fields. This is partly because the law, like Topsy, "jest growed" and partly because law, like medicine, has "mysteries" which the specialists have felt it would be unwise (and unprofitable) to share with the lay public. Entering upon an installation job with all the ethics and good faith in the world can nonetheless expose you to legal obligations and liabilities you never dreamed of. Or the same job may place others in positions of legal liability to you. When this happens, it still may be necessary for you to have some legal guidance to insure that you do not surrender your rights by default.

What we are doing in this section is pointing out the more important general areas in which legal problems can arise in connection with installations. Some of these areas will be of concern to you only if you are in business doing installations, while others will concern you even if you are merely installing a system for your own personal use.

For specific advice on how to protect yourself from legal difficulties (as well as solutions for any that do crop up), you should consult your lawyer and your insurance agent. Your accountant can often assist you in these matters, as well.

If you don't have a lawyer, get one, particularly if you are going into business. Have a good, long session with him before you start, and let him explain to you in some detail the various legal pitfalls you should be on guard against. If you pay careful attention, you won't need to see him again until a claim arises, and that could be years.

Any claims or controversies that do develop can be classified in two basic categories. One includes all matters relating to government regulations--Federal, state or local. The second covers all questions of private dealings--between buyers and sellers, employers and employees, and liabilities to third parties.

Government regulations

All of us are more familiar than we'd like to be with the fact that the Federal government taxes our personal incomes. But if you set up a business, this is just the beginning of the ways in which Government will come into your life.

To stay with taxes for a bit, as soon as you take on help you'll have to deduct Federal and perhaps state income tax from their wages and send it to the right place, at the right times, along with the right forms. In many cases, you'll have to make another deduction under the Federal Insurance Contributions Act (Social Security). This time you get taxed an amount equal to the employee's tax when you send it in. In addition, you may have to fuss with a Federal or a state unemployment tax and disability insurance.

If you are not thoroughly familiar with the Federal requirements regarding withholding of taxes from employee wages, send to the District Director of Internal Revenue in your area, requesting a copy of Circular E. This circular will give you information explaining which employers and employees are subject to which taxes, what constitutes "wages" under the law, how to compute the taxes from the wages, and various other happy bits of incidental intelligence. If you remain puzzled by some points, consult your lawyer or accountant, before you make some mistakes and thereby incur penalties or interest that your pocketbook will find unwelcome. Similar help can be obtained for state and local tax questions.

In doing hi-fi installations, you are not likely to run afoul of Federal agencies other than the Treasury Department unless you violate wage and hour laws. Your lawyer can tell you whether they apply to your operation.

Some states have income taxes, unemployment insurance taxes, corporate taxes, or unincorporated business taxes, and the like, so you'd better find out from your lawyer or accountant whether any of these things exist in your state and, if so, how they affect you.

Also, have them check whether there are any other state agencies that would have jurisdiction over any aspects of your business. Of course, if you are setting up a corporation, this will have to be done by your lawyer through the appropriate state office.

CUSTOMER'S RECEIPT MAKE MODEL RECEIVED (for shop service) SERVICE TECHNICIAN CUSTOMER'S RECEIPT DATE JOB NO. MAKE RECEIVED (for shop service) PER SERVICE TECHNICIAN

Fig. 301. When equipment is pulled for work in the shop, give the

customers a receipt.

In addition to Federal and state taxes, you may be subject to municipal taxes of various sorts. In New York City, for example, there is a real estate tax on the owner of a property, and an occupancy tax on one who rents premises for business purposes. In addition, there is a gross business tax if your business grosses more than $10,000 a year, and there is also a city sales tax. Other cities may have some or all of these taxes, or some others of different kinds. Thus, the tax situation in your municipality requires investigation.

In addition to taxing powers, your municipality will have a building code, an electrical code and health regulations that will affect what you can do in and to a building when making an installation. If, and only if, you are doing an installation for your own use in your own private home, these regulations will not apply. But when you are working in a multiple dwelling, a commercial structure, a public building or someone else's private home, they will apply.

Building, electrical and health codes vary considerably from one place to another. So to be safe, you've no choice but to look up the ones for your particular locality.

An unincorporated business, whether proprietorship or partner ship, may require registration with the county clerk or other public official. This will avoid the complications that could arise if two firms in similar types of business in the same locality inadvertently choose the same name.

Fig. 302. Adhesive tags attached to equipment that has been serviced

aid the technician on the next service call and are good advertising.

Although we have tried to mention the main areas in which installation work could bring you in contact with Government regulation or authority, we don't purport in these few pages to have covered them all. Naturally, very little of our discussion on Government regulation applies to the individual doing his own personal installation, but if you are a professional, we hope we've stimulated you to investigate these matters thoroughly (if you haven't already).

Private dealings

The vast majority of litigation choking up the courts all over the country results from claims and disagreements arising in various ways out of private dealings. And the monumental number of private disputes that actually reach trial is small compared with the number finally settled out of court. A lawsuit of any kind, whether settled in or out of court, will certainly cost you time and possibly a substantial amount of money. Therefore, a suit is to be avoided whenever possible, and a substantial number of the suits that do arise could be avoided if one or both parties used a bit more foresight.

While there are many suits, particularly in the area of accident claims, that reasonable caution could not, or did not prevent, proper insurance can minimize most of the serious dangers.

Keeping good records is good business, helps avoid lawsuits.

If you must pull the hi-fi system for repairs, give your customer a receipt (Fig. 301) but make sure the receipt is filled-in properly.

No one, let alone an audiophile, likes to see precious (and possibly expensive) equipment disappear into the unknown, without some tangible proof of transfer. Putting a gummed label (Fig. 302) inside the equipment (after repair) gives you a capsule re view if and when you get the same job again. Psychologically, from a customer's relations viewpoint, it's a good gambit.

Let's look now at some of the ordinary types of transactions out of which disagreements resulting in litigation can crop up.

Originating a business The fellow who sets up an unincorporated business wholly-owned by himself need go through no elaborate legal procedure.

Once he has complied with the Federal, state, and local regulations that apply to him, he can consider himself technically in business.

He doesn't need extensive business premises, equipment or stock to be legally in business. But before he does any jobs, he'd better have adequate liability insurance because, as the sole proprietor of an unincorporated business, he is personally liable for any claims made against the business. If someone has an accident on his premises, or if there is an accident on someone else's premises involving his installation, tools or equipment, he can be sued. And if a sizable judgment is secured against him, he can be thoroughly wiped out if he's not adequately insured.

When two or more go into business in the form of an unincorporated partnership, they should first, be sure of each other, and second, they should have a complete and thorough partnership agreement drawn. A lot of old friendships have broken apart under the strain of a loosely drawn business partnership.

Remember, too, that in an unincorporated partnership, any or all of the partners are personally liable under the law for the actions of any or all of the others. Translation: one of the boys can get the business in a fix that will ruin all of you.

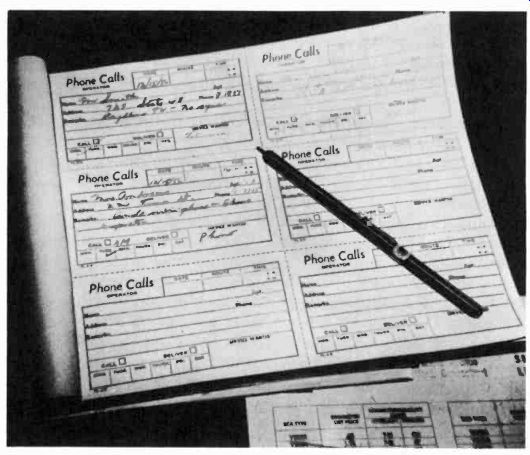

Fig. 303. Requests for service are listed in the phone call book.

One major reason for incorporating a small business is to eliminate the danger of personal liability for business obligations.

Except where improper actions on the part of an officer can be shown, civil suits and judgments against an incorporated business can be leveled only against the corporate entity and not against individuals. Translation: one of the boys can run the corporation or himself broke, but your personal holdings outside of the corporation (your house, car, bank account, etc.) are safe.

Purchases

Of course, the easiest way to avoid litigation in connection with your purchases is to pay your bills more or less on time. But now and then you'll have a reason, other than lack of cash, that seems a valid cause for withholding payment. The question then is will your reason hold up legally.

Suppose you pick up the phone and order 23 standard gilhickies and 3 standard foozles. You don't confirm it in writing and neither does the supplier, who subsequently sends you 23 foozles and 3 gilhickies. Are you stuck because he got the order backward?

Generally not, if you return the incorrect order and let him correct it. However, now suppose you ordered a couple items that he had to make up specially for you, and he did confirm in writing but you failed to notice on the confirmation that he had the order backward. Are you stuck this time with a load of stuff that you don't want? Unfortunately, yes! The worst of it is, you've only yourself to blame. If you had sent a written confirmation of your telephone order, you'd be in the clear. And while we're at it, keeping records of phone calls for service (Fig. 303) is also a good habit.

At least 75% of the problems in connection with purchases can be eliminated by the use of clear, complete written orders stating quantities, specs, terms, delivery dates and method of shipment.

Speaking of shipment, a lot of troubles arise relating to merchandise damaged in transit. If the terms of sale include delivery by the supplier, he may not be directly liable for transit damage, but he will have to claim and collect for it from the carrier. But when the terms are FOB some point at which the supplier delivers the merchandise to a carrier, his responsibility ceases at that point and you'll have to claim against the carrier for any subsequent damage.

Sales

There is little question that the major legal problem in connection with sales is going to be collecting. Only after every other possible means has been tried and has failed should you sue for collection. A suit is expensive, time-consuming and not at all good for your public relations.

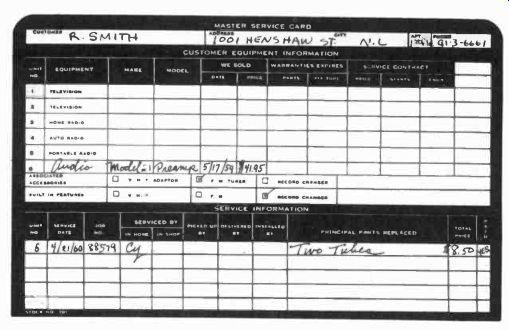

Unless you are particularly unlucky, you won't have to sue very often. Nevertheless, at the time a sale is consummated, you should protect your position in the event that you later have a collection problem. When you take an order, write down everything in detail, e.g., model numbers, colors, delivery date, terms, and prices. On anything over $100, have the customer sign the original of the order (which you keep) and give him a carbon copy. If there are any changes in the order prior to delivery, confirm these in writing and have the customer initial a copy and return it to you (Fig. 304.) A good deal of the trouble and delay over collections develops because the customer thinks he didn't get what he ordered, either in kind or in quality, so he becomes reluctant to pay. If the original order was well-written, reference to it will readily clarify such points.

Fig. 304. Master service card shows all work performed for each customer.

Try to make delivery on the date promised. Delivery on time doesn't mean you'll get paid on time, but at least your customer is encouraged in the right direction. And if your customer isn't home when delivery is made, a short note on your business card (Fig. 305) is proof against future grumbling.

Warranty

Any standard hi-fi components you purchase for an installation will carry a factory warranty of some kind. If you are doing your own personal installation, this is as much warranty as you get, and you'll get a different one on each component.

When you are doing an installation professionally, you do not have to warranty the components beyond the manufacturer's warranty but whether you state it or not, your own work legally carries an implied warranty. By purporting to be a professional, which you've done by taking the job in the first place, you are expected to do work of at least average professional quality. If you don't, you can be required to make good.

By the way, if you or your customer putter around inside a component during the period of the factory warranty, you are very likely to void that warranty, so be very careful yourself and be sure to warn him on this score.

Liability and insurance

Whether you are a home owner, a professional installation man or merely a tenant living in someone else's building, the various kinds of personal injuries and property damage for which you can conceivably be held liable would probably gray your hair instantly if you were aware of the complete list. Better than 70% of all the lawsuits tried in the civil courts throughout the country are claims for damages arising out of personal injuries.

There is no earthly way you can insure yourself against people instituting liability suits against you, but you certainly can insure yourself against the consequences of such suits. The way to find out what kinds of liability insurance you should carry, and how much, is by conferring with a qualified insurance agent. Various individuals. and various businesses will each have different risks and, therefore, different liability insurance requirements.

Of the commoner forms of liability coverage, we'll mention a few. If your agent recommends one we haven't noted, go by what ...

Fig. 305.

If the customer is not at home, a card left in the door shows that

you were there.

...he says. He knows your circumstances and needs--we don't. And we wouldn't dare make recommendations if we did! If you are in business and have as many as one employee, you should have Workmen's Compensation coverage. In many states you have no choice, since it is required by law. But required or not, carry it! All you need is one serious accident and that employee could clean you out right down to your shoelaces.

Your agent can also advise you regarding nonoccupational disability coverage. This is an additional form of protection for employees.

Depending upon the type and extent of your business operations, a number of additional coverages available protect you against liability claims from customers and from what are called "third parties." A third party is someone not directly involved in a transaction with you, who may be injured while you are pursuing the normal course of your business. Owners', landlords' and tenants' liability, manufacturers' and contractors' liability, and storekeepers' liability are common forms of such coverage. Each covers a different range of risks so find out whether you need any of them, or perhaps something else entirely.

You'd also do well to find out whether you should carry comprehensive personal liability on yourself, your family and your home.

A happy thought in connection with insurance is that your insurance company will defend you legally against any claims or suits for liabilities covered in your policies, making it unnecessary for you to go to any personal expense to defend such claims.

To repeat what we said at the outset of this section, we have not attempted to give you any legal advice whatsoever. If, however, we have run a cold chill or two down your spine sufficient to send you scuttling off to your attorney, accountant or insurance agent, we have succeeded admirably in our purpose, which has been to induce you to take the necessary steps to protect yourself.